Quezon City, November 11, 2021. The Fertilizer and Pesticide Authority (FPA) recognizes the ongoing plight of local farmers relative to the hike in fertilizer prices. With increased farm production expenses (vis-à-vis increased fertilizer prices) comes reduction of profit margins.

Why are the prices of fertilizers increasing? Can FPA control the prices?

As an explanation, FPA attributes the current price hike to the following: 1) liberalization of fertilizers; 2) the country as a net importer of fertilizers; 3) strengthened global fertilizer demand; 4) increased prices of raw materials; and 5) increase transport and logistical costs.

Price uptrend, current supply

Fertilizer prices were stable until the uptrend started in March 2021 for the six (6) major fertilizer grades (Figure 1). As of October 2021, the increase in prices for 50kg/bag ranges from 18% to as high as 38% namely: Muriate of potash (MOP) at Php 1,412.98 from Php 1,195.43 (18% increase); Di-ammonium phosphate (DAP) at Php 1,927.57 from Php 1,602.86 (20% increase); Complete fertilizers (T14) at Php 1,378.17 from Php 1,112.70 (24% increase); Ammonium phosphate (Ammophos) at Php 1,275.60 from Php 976.34 (31% increase); Nitrogen (Urea) is at Php 1,540.17 from its Php 1,166.14 in January 2021 (32% increase); and Ammonium sulfate (Ammosul) at Php 842.86 from Php 612.44 (38% increase).

Figure 1. Trend of Fertilizer Prices for the Six Major Grades (2019-2021)

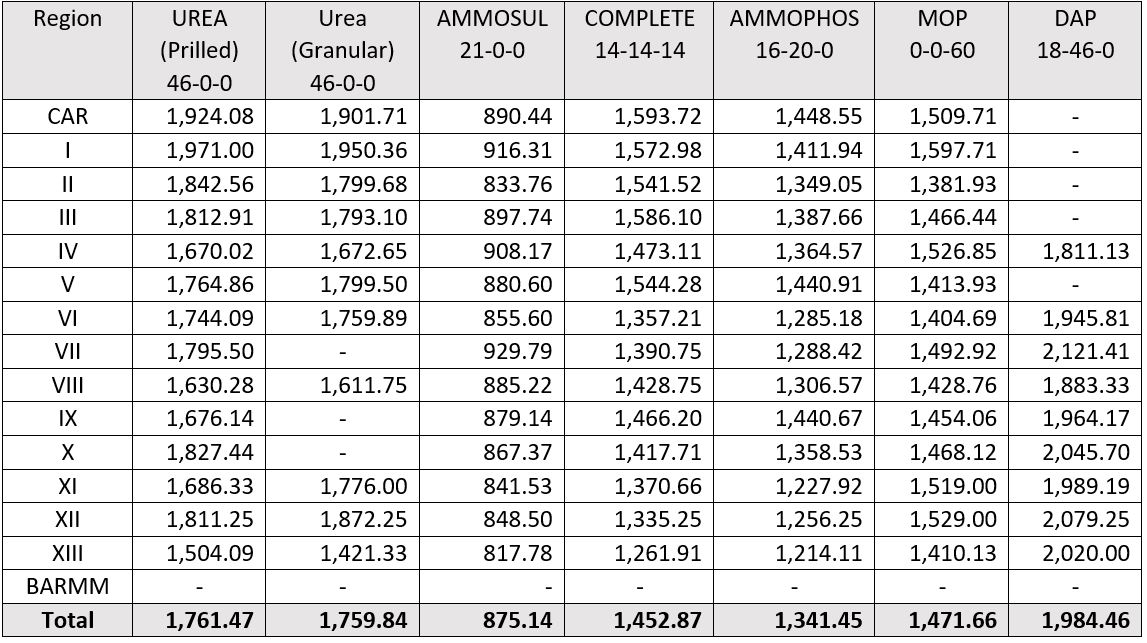

The regional average retail price of the six (6) major grades of fertilizers per 50kg/bag as of October 22, 2021 is shown in Table 1.

Table 1. Average Retail Price per 50kg bag of Six Major Grades of Fertilizers (October 18-22, 2021)

Table 2 presents the available stock inventory of fertilizers from the different handlers nationwide. This presents the current supply of fertilizers (per bag) in each region and the total available stock nationwide.

Table 2. Stock Inventory of the six Major Grades of Fertilizers per 50kg/bag (October 18-22,2021)

Liberalization of fertilizers impacts users

Because of the implementation of the Tariff Reform and Import Liberalization Program in 1986 leading to the liberalization of fertilizer importation and other agricultural products, the government has since then stopped imposing import quotas for fertilizer and reduced the corresponding import duties and tariffs on fertilizer imports (Briones, 2020).

In response to the program, FPA issued a Memorandum Circular No. 1 series of 1986 which provides the decontrol guidelines for the fertilizer industry. This issuance relinquished the FPA of its control over procurement of fertilizers particularly on the determination of import requirements and allocation of import volume, and conducting tenders or canvasses for fertilizer importations.

Thus, the FPA lose its capacity to “assure the agricultural sector of adequate supply of fertilizer and pesticide at reasonable prices…” as stipulated under PD 1144.

Philippines: Net importer of fertilizers

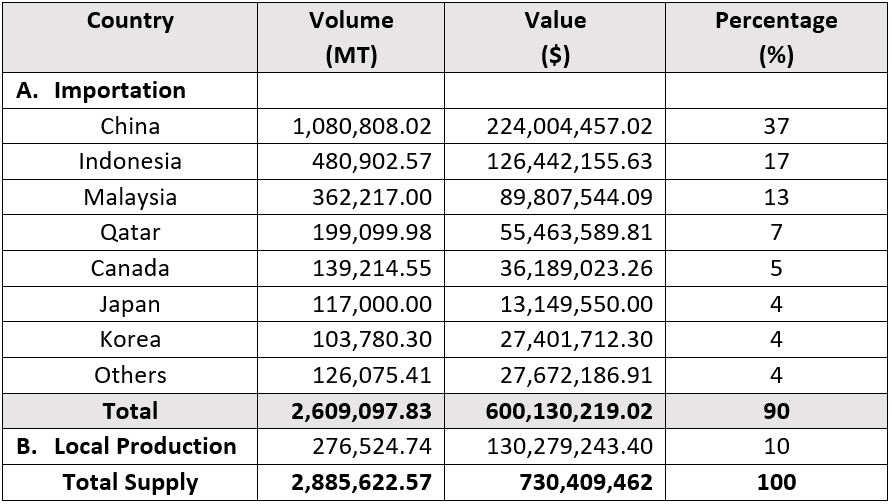

The country has been for a long-time a net importer of fertilizers. About 90% of the country’s needs for fertilizer are mostly imported from China, Indonesia, and Malaysia. Some are being imported from Qatar, Canada, Korea, and the Middle East, while local production accounts for only 10% of the country’s fertilizer supply (Table 3).

There are two major local producers of fertilizer namely: Atlas Fertilizer Corporation and the Philippine Phosphate Fertilizer Corporation (Philphos). Small to medium sized fertilizer manufacturers also contribute to the local production but in smaller quantities. According to Vice President Tomas Guibanni, Philphos capacity to operate is only at 20% (interviewed November 9, 2021). Raw materials being used are likewise imported and fertilizer production requires large amounts of fossil fuels. Much so, it would not be feasible for the country to produce its own fertilizers given that the Philippines is not an oil-producer.

Table 3. Exporters of Six Major Grades of Fertilizer in 2020

Global Scenario: Increased fertilizer demand

With the country’s dependence on imported fertilizers, the current global demand greatly affects the entry of fertilizer imports in our country. This caused limited local fertilizer supply that influenced the escalation of local prices.

According to the World Bank (2021), fertilizer prices are expected to stay high over the remainder of 2021. Their report indicated that an increase in the importation demand of fertilizers were recorded, particularly urea, in countries like the US, Brazil, India, and Australia. These countries have increased production area for corn, soybeans, and wheat requiring large volumes of agricultural fertilizer inputs.

As such, some countries have also made an advanced booking of fertilizer particularly urea to meet their domestic demand. India has already made an advance booking of fertilizer supply (1.8M MT) for them to meet their domestic demand of approximately $501/MT. In the US, prices of corn are fueling expectations of higher demand for urea, hence higher prices. In Australia, a forecast of a 2% yearly increase in fertilizer demand has been recorded, with crop areas expanding by almost 400,000 hectares yearly in New South Wales. In Brazil, corn production has been increased for livestock use (forage) whereby urea imports grew to 8 million MT until 2022.

Moreover, China, the highest origin of Philippine fertilizer imports, has allocated their local fertilizer production for their domestic use. This resulted in reduced fertilizer exports to the Philippines.

Increased cost of raw materials

The World Bank (2021) reported that the high price of fertilizers has been bolstered by increased prices of raw materials to produce fertilizers. For instance, the cost for phosphates raw material costs, particularly sulfur and ammonia, have increased sharply due to COVID-19 restrictions on transport that caused limited input supplies. In addition, urea feedstock costs have also risen, including natural gas prices (to produce urea) which jumped in early 2021 due to unusually cold weather.

Increased transport and logistical expenses from importation to retail

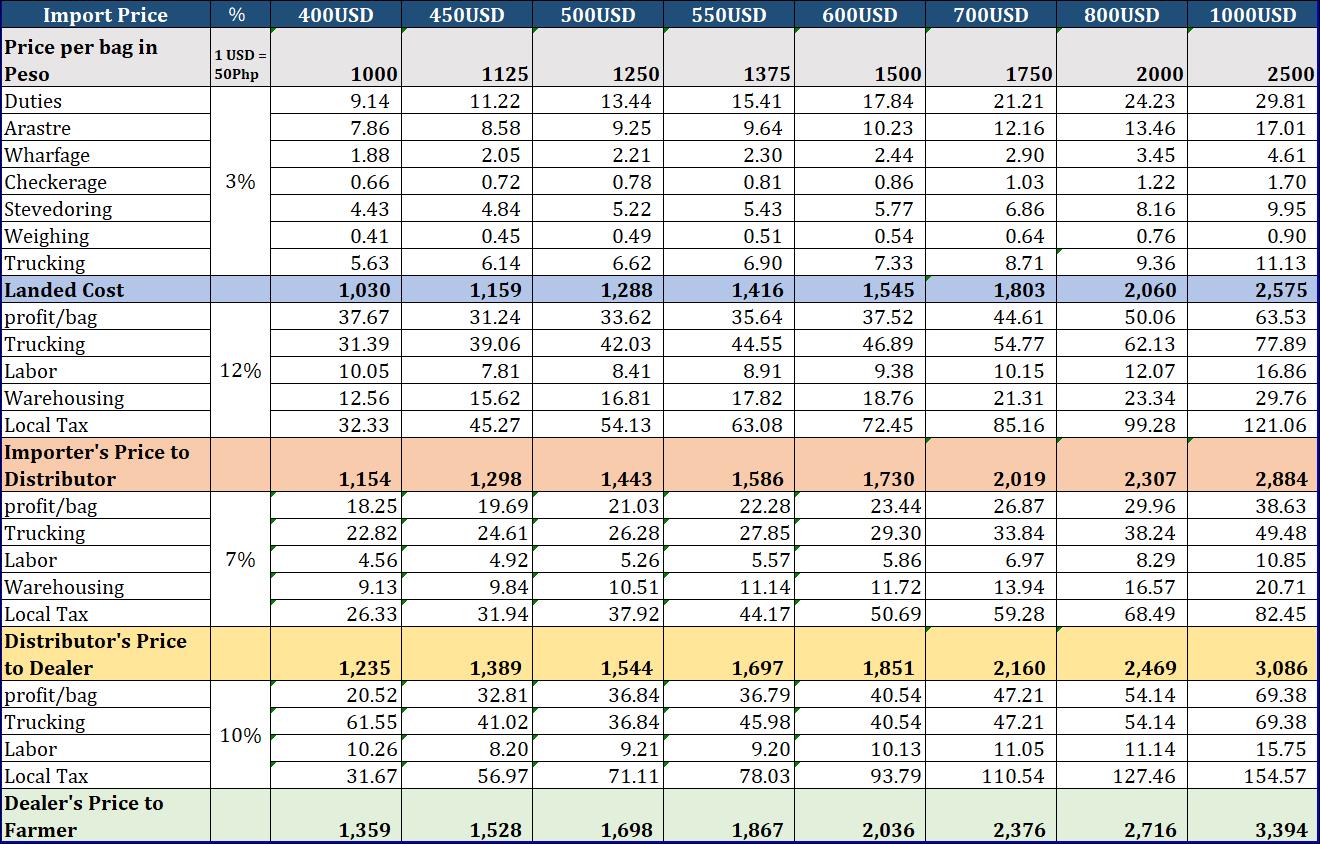

The increased transport expenses in the delivery of fertilizers from its country of origin to local dealer’s level also affected local fertilizer prices. Among the overhead expenses include duties, arrastre, wharfage checkereage, stevedoring, weighing or bagging and trucking. This will be incurred upon the landing of fertilizers from port to its transport to the distributor’s warehouse and to the different dealers nationwide. An increase in freight cost in ASEAN has been also recorded from $20 to $40 in recent months.

Table 4 illustrates the imputed costs across the supply chain – from the time fertilizer is unloaded in our ports to the point the dealers sell it to farmers. For instance, if the import price is $700 per metric ton, the computed price per bag (at a foreign exchange rate of Php50.00 per $1) is Php1,750. Add the duties, arastre and stevedoring (which is around 3% of import price according to industry standards), then you come up with the landed cost of Php1,803. The importer and distributor then shall impute their margins and costs at 7% and 10% respectively for logistics, labor, and local tax to come up with importer’s price to distributors and distributor’s price to dealer. Finally, the dealer’s price to farmers shall now include all the imputed costs across the supply chain would be approximately Php2,376.

Table 4. Sample Computation of Fertilizer Price at Various Level (Php)

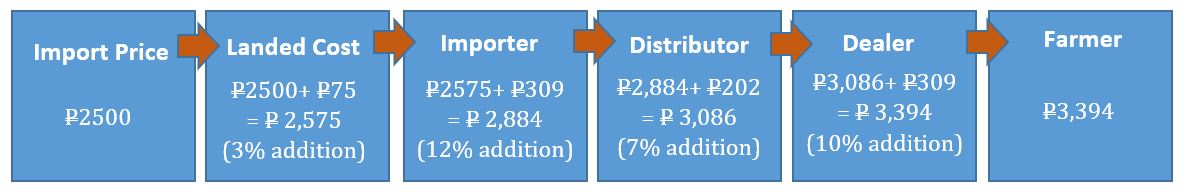

To illustrate the 32% additional value (from the time the fertilizer is unloaded in Philippine ports by importers), if the import price is $1,000, price per bag in peso (50 kgs) would be Php2,500. An additional Php75 (3%), constituting import duties, arastre and stevedoring expenses, will be added to the import price. Successively, 12% or Php309 will be added by the importer upon selling to distributor. Another Php202 (7%) will be added by distributor to dealers. Finally Php309 (10%) will be added by dealers upon selling to farmers. From the Php2,500 landed cost of fertilizer, the farmer would now have to buy the fertilizer at Php3,394 with the addition of transport and logistical charges from various level (Figure 2).

Figure 2. Schematic Diagram Showing the Increasing Fertilizer Price from the Landed Cost of Php2,500 to Farmer’s Level

Proposed interventions to combat increase in fertilizer price: OneDA approach

To address the concern of high fertilizer prices, FPA proposes eight strategic interventions:

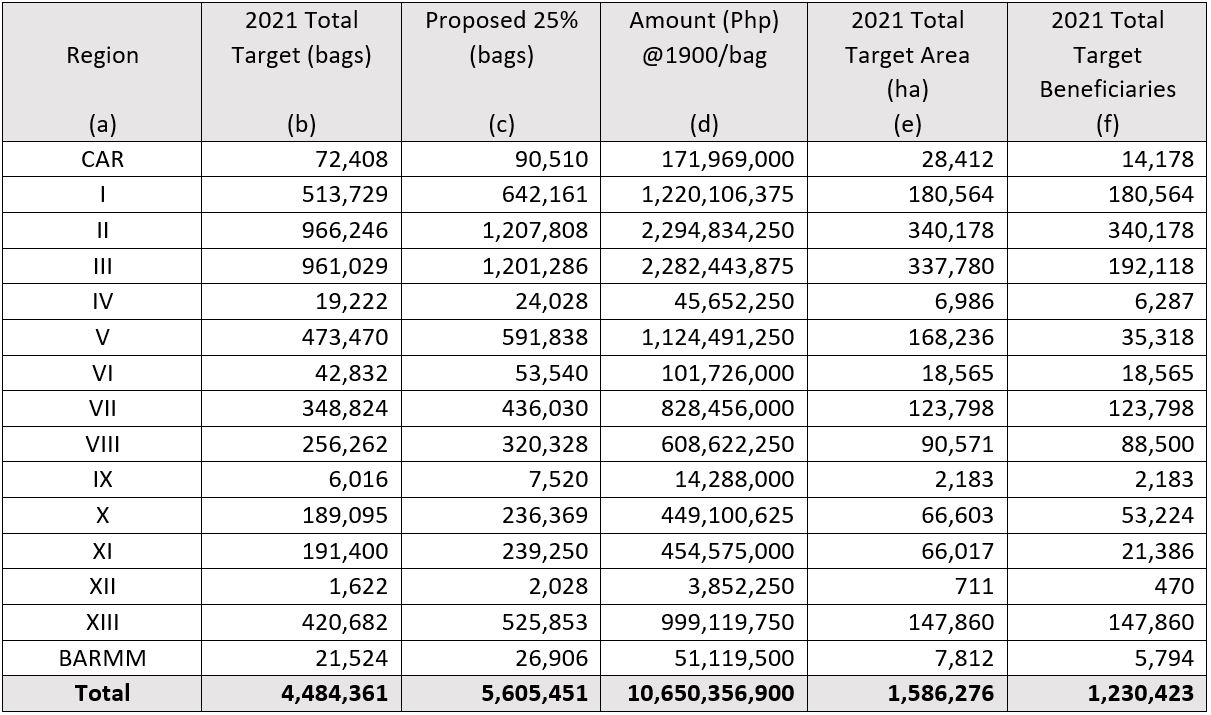

– 1st, Government needs to increase farmers fertilizer subsidy by 25% from the initial grant of Php 1,000 (Table 5). The enhanced fertilizer subsidy would defray farm expenses of farmers and cover a higher target area of application for increased production.

Table 5. Proposed 25% Increase from Traditional Fertilizer Subsidy of Php 1000

– 2nd, Government to provide a subsidy of at least 60-70% of the prevailing price on traditional and non-traditional fertilizers.

– 3rd, Government must encourage Farmers’ Federations and Associations to import fertilizers. Subsidize cooperatives/associations by providing loan on zero interest. This would increase local fertilizer supply and promote market competition to balance local prices.

– 4th, Government to provide soft loan assistance, or in other forms, to Philphos to fully operate in order to increase local production by 20% or more in the market.

– 5th, Government should introduce a Price Guide Indicator at various import price levels. This will facilitate easier price monitoring of fertilizers to allow distributors and dealers to maintain reasonable fertilizer prices.

– 6th, FPA to constant monitor and conduct surveillance on stock inventory and local pricing.

– 7th, FPA shall also strengthen its awareness campaign efforts to educate farmers to use cheaper FPA registered fertilizer brands in the market that has the same efficacy as the known brands.

– 8th, FPA will also promote the use of Balance Fertilization Strategy to farmers to address problems on land degradation and decline in soil fertility through adjustments in the cropping and management of farming systems by means of cover cropping of short duration leguminous crops (i.e. mungbean) and introduce non-traditional fertilizer subsidies such as organic fertilizers, fortified organic fertilizers, and the microbial/biorational fertilizers.

The use of fortified organic fertilizers (organic + inorganic) is advantageous. Given that we have all the ingredients (i.e. dung – poultry and livestock, crop refuse) and producers to manufacture this, specific nutrient formulation that will suit crop requirement is vital.

This strategies will allow farmers to minimize the use of costly fertilizers through effective and efficient input application.

References:

Briones, R. 2020. The Unfinished Agenda of Trade Liberalization in Philippine Agriculture: Assessing the Impact of Reducing Tariff and Nontariff Barriers. Retrieved https://pidswebs.pids.gov.ph/CDN/PUBLICATIONS/pidsdps2042.pdf. P9.

Baffes, J. and Koh, W. 2021. Fertilizer prices expected to stay high over the remainder of 2021. Retrieved https://blogs.worldbank.org/opendata/fertilizer-prices-expected-stay-high -over-remainder-2021

Written by 1Wilfredo Roldan, *2Myer Mula, 3Julieta Lansangan, 4Rowena Reyes, and 5Ivan Layag l Published: 11 November 2021

1 Executive Director, Fertilizer and Pesticide Authority (FPA)

*2 National Program Director, Special Area for Agricultural Development (SAAD) and Deputy Executive Director for Fertilizer, Fertilizer and Pesticide Authority (FPA)

3 Division Chief , Fertilizer Regulations Division (FRD), Fertilizer and Pesticide Authority (FPA)

4 Supervising Agriculturist, Fertilizer Regulations Division (FRD), Fertilizer and Pesticide Authority (FPA)

5 Information Officer III, Planning, Monitoring and Information Division (PMID), Fertilizer and Pesticide Authority (FPA)

Fertilizer and Pesticide Authority (FPA) Online ISSN: 2815-1674

Published by the FPA Information and Communications Team